Reporting

Monthly payroll report

- Showing, for each employee, the following: basic salary; additional income; deductions; withholding tax payable; employees SSF contribution; Provident Fund contribution; net salary payable.

- Details of the staff that have resigned, terminated or joined client that month.

- Variance report showing the current and previous month.

Confidential personalised payslips

- Employees can access by mobile or through a web- based platform – HReasily. Carbon copies can also be printed and distributed.

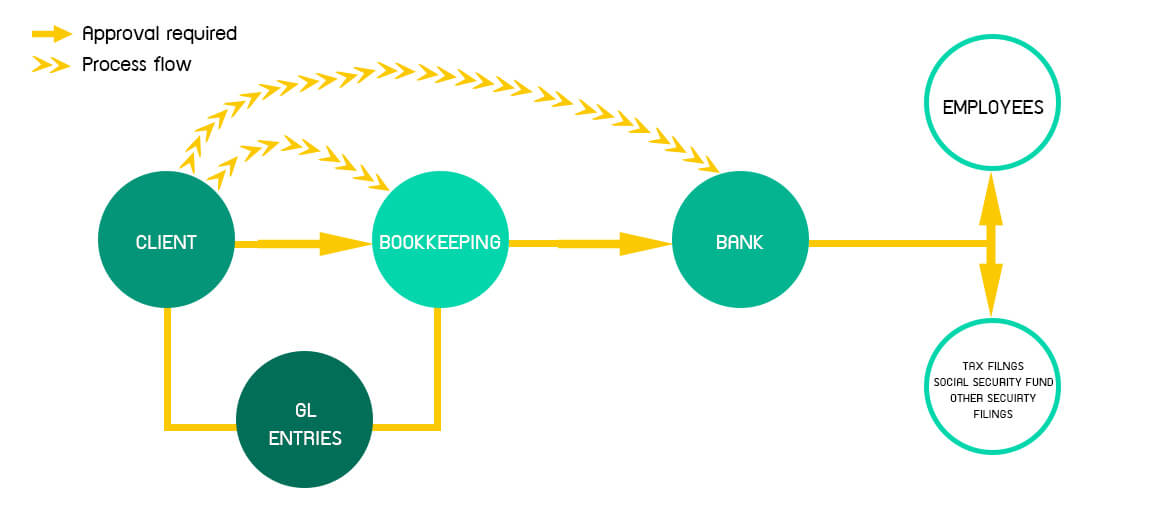

Payroll withholding tax form (PND-1)

- To be generated electronically and submitted by Bookkeeping on behalf of the client.

Social Security Fund form (SPS1-10)

- Recommended to apply for Social Security Fund e-filing

Social Security Fund – SPS series forms (SPS1-03, 1-03/1 and 6-09)

- Optional service to handle the administrative tasks around leavers and joinders and changes to the client’s particulars.

Provident fund

- Employers and Employees’ contributions will be summarized and submitted to the provident fund management company.

- Bookkeeping can provide Provident Fund administration services.

Withholding Tax Certificate (50 Tawi)

- Prepared for departing employees.

Other

- Prepare payroll accounting journal entries.

- Inform clients of any changes to or new regulations that impact payroll processing.

On a annual basis:

- Workmen’s Compensation Fund Forms (Kor Tor 26 Kor and Kor Tor 20 Kor)

- Employee Withholding Tax Certificate (50 Tawi)

- PND-1 Annual Summary Form (PND-1 Kor)

- Personal income tax returns (PND-91) for expatriate employees only