In today’s interconnected global economy, the Financial Hub concept is vital. These locations are more than just cities with many banks. They are centers driving capital flow, financial innovation, and complex global services.

A true financial center, by basic definition, is a city or economic zone rich in financial activities. This includes banking, investment, insurance, asset management, and capital markets. It also needs strong legal and tech infrastructure. This supports efficient operations.

The Crucial Role of a Financial Hub in the Global Economy

A financial center serves a key role globally. Here’s why:

- Concentration of Capital and Services: It gathers capital worldwide. This creates investment and market liquidity.

- Innovation Generation: It fosters FinTech and new financial products. This accelerates progress within its ecosystem.

- Economic Opportunities: It attracts foreign investment. It creates high-value jobs. This boosts economic growth.

- Standards and Governance: It often sets industry standards. This enhances overall credibility.

Challenges and Considerations in Developing a Financial Hub

While becoming a Financial Hub offers huge benefits. However, it also brings significant challenges and risks. Careful management is essential. Every aspiring financial center must address these points:

- Regulatory Risks: Weak regulations can make a financial center a channel for money laundering or terrorism financing. This can harm its credibility and stability.

- Internal Stability Risks: Global links expose such a center to external shocks. Proper segregation and protection are vital to prevent contagion.

- Strong Oversight: There must be mechanisms that allow regulatory bodies to intervene promptly during crises. This maintains system stability.

- Preparedness: Do not rush establishing this kind of center. Regulators need thorough preparation. A clear strategic vision is crucial for its long-term success.

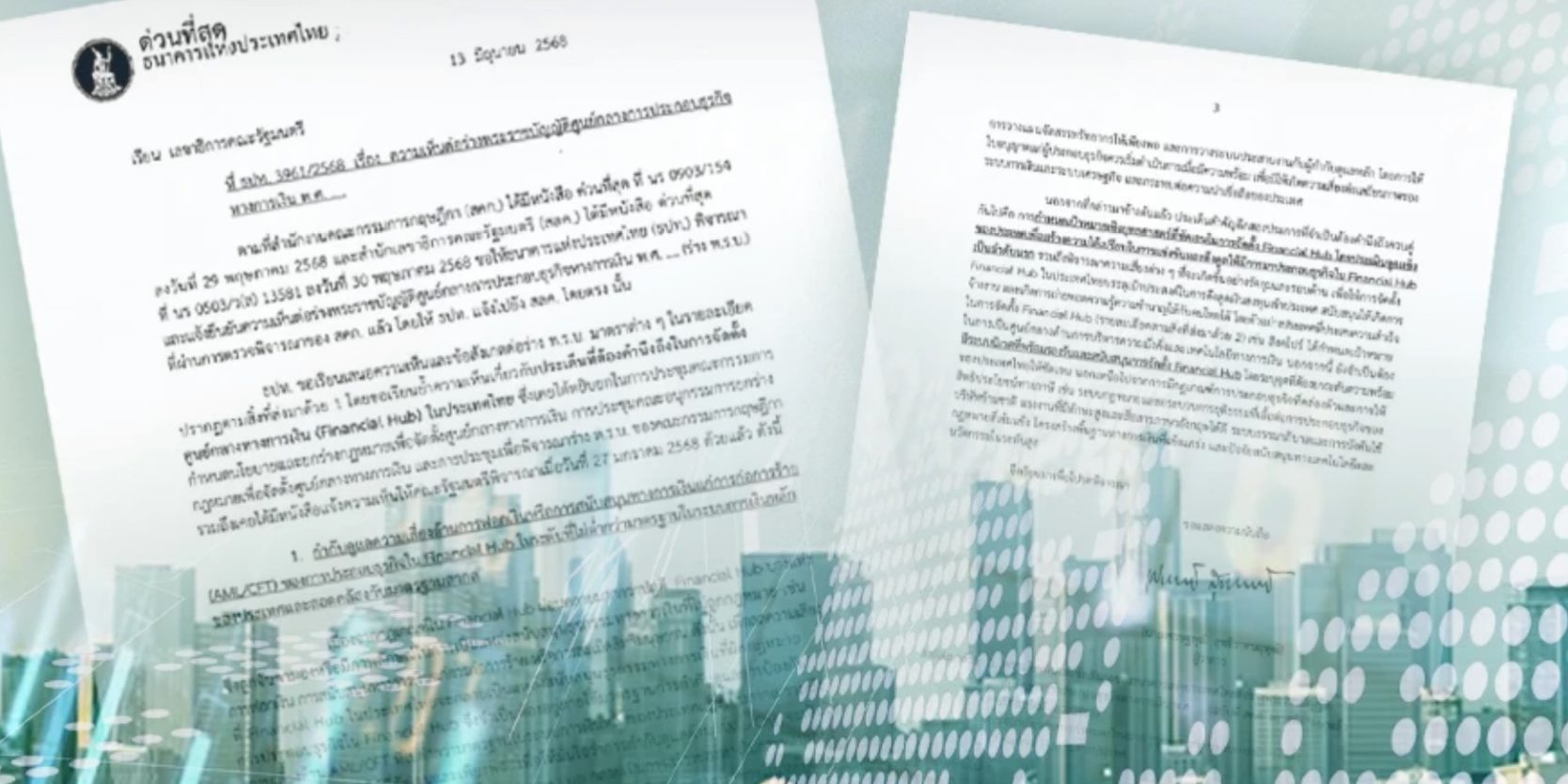

Case Study: Bank of Thailand’s Stance on Financial Hub Development

The Bank of Thailand (BOT) has significant concerns regarding the establishment of a Financial Hub, highlighting key issues.

- Clear Segregation: The BOT insists the hub must be completely separate from the domestic financial system, both in terms of legal entities and physical operating areas. This prevents potential risks to the internal system.

- Non-Resident Services Only: The financial center should exclusively serve non-residents.

- Control and Oversight Mechanisms: The BOT demands clear mechanisms. These let regulators like the BOT, SEC, and OIC intervene. They need to issue directives during crises.

- Anti-Money Laundering and Counter-Terrorism Financing: The BOT worries about lax regulations. An insufficiently regulated financial center could become a conduit for illicit financing.

- No Rushing and Clear Vision: The BOT stresses not rushing this establishment. The hub’s regulatory body must be fully prepared. A clear strategic vision is needed before operations start. This preserves the country’s financial credibility.

Dubai International Financial Centre (DIFC): A Successful Financial Hub Example

The central bank cited the Dubai International Financial Centre (DIFC). This clearly delineated financial free zone is a successful example of segregation and management. It offers an interesting model for other countries developing a Financial Hub.

Conclusion: A Financial Hub – Hope Accompanied by Responsibility

Developing a Financial Hubs offers a big chance. It can elevate a country’s global financial role. However, sustainable success needs careful risk management and strong regulations. Collaboration among stakeholders is vital. This ensures such a hub truly drives economic growth without harming national financial stability or credibility.

References:

- Nation Thailand: Bank of Thailand warns over ‘Financial Hub’ risks

- Bank of Thailand (BOT)

- Dubai International Financial Centre (DIFC)